When we are on a gold standard, the amount of dollars in the economy is tied into the amount of gold we have, so no printing of dollars on someones say so, without the equivalent amount of gold or silver into the hands of spenders, to keep inflation down and keep and retain the value of the dollar based on the gold behind it.

Using the "printing press" to bring us out of depression or recession, simply delays the results of "overspending" price hikes with too much cash and too little products to buy, pushes prices up, by too many dollars chasing too few goods, which adds to inflation and devaluation of the dollar. Its a cycle that never ends, so that is why wars are needed. In other words, the blood of our children in wars, is how they fix the economy and that is unacceptable.

The battle historically between our true citizens, elected reps, and President, with the bankers, almost always resulted in either deaths or massive, horrible scandels that ruined honourable politicians reputations when they tried to take on the Federal Reserve and international banking. (Primarily the British Rothschilds).

The fed is still fighting auditing Fort Knox and our gold. The bankers also put Germany's gold in the fed here in America and when the Germans asked for their gold back, the fed refused saying they would have to wait ten years. Now when did the fed take over anyone’s government in order to make that kind of decision?

We will be publishing a blog about how Hitler betrayed the Rothschilds during WW II and arrested one of them for their fiat currency scheme. Hitler than began using the mark again as Germany's sovereign currency and the nation recovered.

That is when the bankers decided to implement their plan for WW II, offered by Albert Pike way back in 1871. Its also why iran is a target now. It never had anything to do with nukes, it had everything to do with Iran's trading oil for Euro's instead of dollars as was the case for fiat currency since the Euro is 15% backed by gold and is competing with Rothschilds petrodollar that is only backed by oil and no gold.

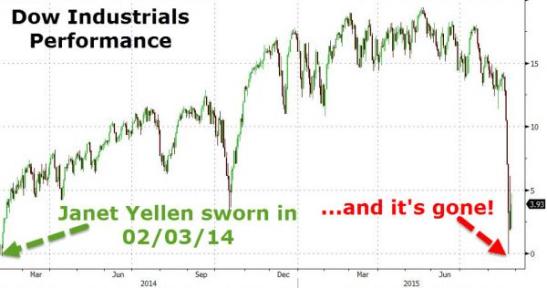

Nullifying The Federal Reserve: ……and it’s Gone!

http://politicalvelcraft.org/2015/08/26/nullifying-the-federal-reserve-and-its-gone/

By Admin, Political Velcraft, August 26, 2015

Central banks are the bane of any society yearning to remain free. But there are ways we can undermine their power, and their monopoly control over the economy, through state and individual action.

Since the founding of the U.S. central bank known as the Federal Reserve, the dollar has lost an incredible amount of value in terms of purchasing power. An item worth $1 in 1913 costs $24.11 today.

This is a direct result of the Fed because its actions debase the currency. That simply means the average American has less purchasing power. For example, following the 2008 economic collapse, the Fed engaged in multiple rounds of “quantitative easing.”

In plain speak, they are simply printing more money. Central bank monetary policy perpetuates booms and busts, and we can directly trace recent economic crises to government monetary policy facilitated by the Federal Reserve.

The good news is that we can take steps, both at an individual and state level, to undermine and potentially nullify the Federal Reserve, no matter what political party controls the White House and Congress.

1. Have States Create Their Own Gold Depositories

Texas recently passed a bill that creates the nation’s first state-level gold depository. This will serve as an important first step toward establishing gold and silver as commonly-used legal tender in the state. Thanks to this new law, a person will be able to deposit gold or silver in the depository, and then pay other people through electronic means, or by check, with sound money.

By making gold and silver available for regular, daily transactions by the general public, gold depository laws have the potential for wide-reaching effect. Professor William Greene, an expert on constitutional tender, said that when people in multiple states actually start using gold and silver instead of Federal Reserve Notes, it will effectively nullify the Federal Reserve and end the federal government’s monopoly on money.

While these laws won’t nullify the Fed’s monetary monopoly on their own, they represent an important step forward in that direction.

2. Constitutional Tender Acts

On the state level, Constitutional Tender Acts help promote sound money by introducing currency competition with Federal Reserve Notes and return a state to the Constitution’s “legal tender” provisions of Article I, Section 10:

“No State Shall…make any Thing but gold and silver Coin a Tender in Payment of Debts”

As part of the act, the state would be required to use only gold and silver coins – or their equivalents, such as checks or electronic transfers – for payments of any debt owed by or to the state, including taxes, fees, contract payments, and the like.

The law would require all such payments to be denominated in legal tender gold and silver U.S. coins, including Gold Eagles, Silver Eagles, and pre-1965 90% silver coins. The market would then require that all state-chartered banks – as well as any other bank acting as a depository for state funds – offer accounts denominated in those types of gold and silver coins, and to keep such accounts segregated from other types of accounts such as Federal Reserve Notes.

3. Promote Individual Purchase of Gold and Silver

Although individuals can currently purchase gold and silver coins or rounds to store wealth, the two steps above would help introduce their use in ordinary transactions and replace Federal Reserve notes. The increased usage would then inspire the creation of silver and gold rounds convenient for small purchases, and encourage further circulation of precious metals.

While the price of gold and silver can rise and fall, this is a reflection of the volatility of the dollar, not of precious metals. Before the creation of the Fed, the value of the dollar remained remarkably stable. Sound money maintains its purchasing power, and would likely quickly replace federal reserve notes as the preferred medium of exchange, due to its stability and its ability to retain value over time.

4. Use Bitcoin And Other Decentralized Currencies

Individuals can also turn to alternative, decentralized currencies, such as Bitcoin, an open-source payment system. It is not controlled or owned by anyone, and so it is not susceptible to manipulation or inflation by a central bank like the Fed.

A person stores their own Bitcoin in a software wallet, and can purchase Bitcoin using regular money. Bitcoin can be used in any country. And unlike bank accounts, Bitcoin accounts cannot be frozen or seized by a government. For people looking to use Bitcoin to sell things, fees for transactions are lower than credit card processors, and the buyer is the one who pays the fee.

TAKE ACTION

Taking action on all of these fronts would help undermine the Federal Reserve’s efforts to centrally plan and control the economy by offering people other options, not only for storing and retaining their wealth, but also in the manner in which they exchange it for goods and services.

Through state and individual action, Americans can take control of their own currency and end monopoly control of money by the federal government.

Michael Boldin and Mike Maharrey contributed to this article.

Tenth Amendment Center

1913 Rothschild Federal Reserve ~ A Non Federal Entity Illegally Written Into Acceptance By Rothschild Soldier Woodrow Wilson.(VN: handled by the rothschild

operative, Mr. House.)

operative, Mr. House.)

- Summarizing The “Black Monday” Carnage So Far!

- Zionist Henry Kissinger Wrote FOOD CONTROL GENOCIDE in 1974.

- China Turns Currency War Nuclear: Silver Gold Demand Outpaces Supply.

- Federal Reserve Boxed In: Black Monday & 30 Day Reset Or QE4 Kick The Can?

- Stock Market Crashes Occurring Now In 23 Nations Around The World: Greece Receives 1000 Bitcoin ATMs.

- Obama’s Iran Nuclear Deal For Israel: Keeping Iran Impoverished ~ Deal Reduces Oil Production From Iran’s 2.5 MBD Capacity To 1.1 MBD.

The article is reproduced in accordance with Section 107 of title 17 of the Copyright Law of the United States relating to fair-use and is for the purposes of criticism, comment, news reporting, teaching, scholarship, and research.

No comments:

Post a Comment